A Deep Dive into Real-time Fraud Detection and Its Role in Combating UPI Frauds

Introduction

As innovation and agility transform the digital payment landscape, the surge in UPI fraud is indeed an alarming concern. According to a Business Standard report, since the financial year of 2022-23, total losses due to UPI scams exceeded ₹2,145 crore across around 2.7 million incidents.

Conventional fraud detection techniques have proven inadequate in addressing this issue. Fraudsters with tech-advanced, sophisticated approaches may come up anytime, exploit the vulnerabilities in your fraud management system, and put customers’ money and your reputation at risk.

Therefore, to prevent and handle today’s advanced UPI frauds, the implementation of smart and new-age real-time fraud detection solutions in banks and financial institutions has become necessary. It is a method empowered with advanced adaptive intelligence to identify suspicious patterns in financial transactions immediately. It quickly recognises the risks of fraudulent activities and helps to take measures against them, securing the banks’ reliability.

This blog highlights the essential details of how real-time fraud detection techniques can combat UPI fraud efficiently.

How Real-time Fraud Detection Techniques Help to Combat UPI Frauds

Following the COVID-19 pandemic, the popularity of UPI or Unified Payment Interface is quite prevalent across industries, which has led to the emergence of diverse UPI payment platforms and techniques. However, with this inclination for UPI payment across multiple platforms, many potential entry points for fraudsters are opened, increasing the threat of UPI fraud that can happen in seconds. Therefore, banks and financial institutions must be well-equipped with new-age fraud management solutions to ensure economic security for their customers. Here is how real-time fraud detection techniques can help in this process.

Deep Learning and ML:

While machine learning (ML) is a type of artificial intelligence that involves algorithms trained to learn from acquired data and make decisions, deep learning is a subset of ML that comprises artificial neural networks mimicking human brains, which learn complex patterns. Combining advanced deep learning and ML technologies, real-time fraud detection methods identify unusual patterns, analysing large and diverse data sets to detect anomalies that hint at the occurrence of fraud. Thus, the fraud detection solution can understand new patterns of fraud and prevent them beforehand, outperforming traditional fraud recognition systems that work with predefined rules only.

Smart Risk Scoring to Prioritise High Threat Transactions:

Often, real-time transaction monitoring involves a custom risk scoring model in which a score is assigned to every transaction to denote the intensity of risks in it. The risk scores are set based on factors such as transaction amount, user behaviour, geographic location, etc. The transactions with high risk scores are therefore prioritised for monitoring and scrutiny. This targeted approach is helpful in improving the fraud detection process while minimising the risks of false positives.

Dynamic Rules That Adapt to Different Transaction Types:

When real-time monitoring takes place, certain definite rules are also used to quickly identify suspicious transactions and block the activities in question at the moment. Moreover, different patterns like geolocation monitoring patterns, historical behavioural patterns, transaction velocity checks, etc., are set to monitor diverse types of UPI transactions like peer-to-peer transactions, B2B payments, peer-to-merchant payments, UPI reversals, etc., so that no activity is left unsupervised in any way. With dynamic patterns and pre-packaged rules, the security against UPI fraud grows stronger than ever.

Continuous Monitoring and Analysis:

Unlike traditional fraud detection techniques, which don’t include regular supervision sometimes due to a shortage of resources or time, real-time fraud management method ensures uninterrupted monitoring across various platforms. In addition to continuous supervision, advanced analysis of the transactions is also available in real time, so that fraudsters find no entry points to get into the system and manipulate transactions.

Seamless integration with existing systems:

The new-age technology used in the real-time payment fraud detection method integrates smoothly with the existing payment platforms and other tools and techniques. For example, if your bank already uses a fraud detection tool, you can incorporate real-time transaction monitoring with it and enhance the security of your financial transactions.

Proactive Alerts and Automated Reports:

While traditional fraud detection techniques, due to their lagging mechanisms, may take some time to send the alerts after identifying the suspicious activities, real-time methods warn you instantly, even within 100 milliseconds, and send automated, detailed reports. Additionally, with the help of real-time fraud detection techniques, banks and financial institutions can get valuable insights into ongoing and emerging fraud trends, which enables them to strengthen their security measures against fraud.

Want to get some insights on how UPI fraud works? Click here.

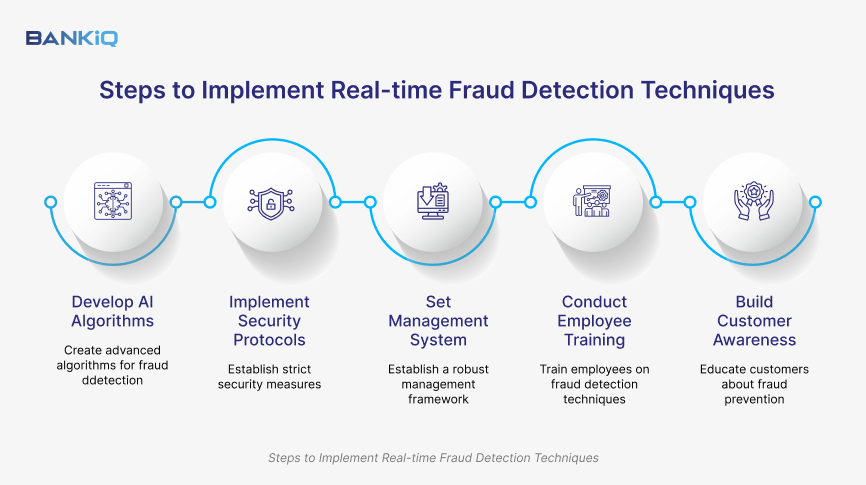

Steps to Implement Real-time Fraud Detection Techniques

With self-learning capabilities and automated preventive features, real-time payment fraud detection methods can combat the modern diversified nature of UPI fraud. However, here are the steps that banks need to follow to implement real-time fraud detection techniques.

Develop AI-powered algorithms:

AI, including machine learning capabilities, is the base of any real-time fraud detection technique. Therefore, banks need to focus on developing AI-powered algorithms which create adaptive analytics so that the system can detect fraud despite its evolving nature. AI tools like deep fake detection, selfie verification, etc, can be implemented to strengthen the security against any unethical financial practices.

Implement strict security protocols:

Regardless of who the user is or how small or big their transactions are, implementing strict security measures for every transaction is crucial. The protocols may include biometric authentication, KYC verification, and multifactor authentication. This enhanced security helps to protect the system from fraudulent activities.

Set a robust management system:

A systematic and powerful system is essential to manage the overall real-time security measures. To develop such a management system, banks and financial institutions should take a layered approach combining technology, well-designed plans and human expertise. Together, they should move forward to fulfil a clear objective.

Conduct regular training for employees:

To ensure the best utilisation of the real-time fraud detection solution, employees in a financial institution should be well aware of the features and capabilities of the solution. Conduct proper training sessions to help them understand new-age fraud tactics and how, by using real-time techniques, those activities can be detected immediately and responded to before causing any loss.

Build customer awareness:

Along with improving employees’ knowledge and experience, customers should also be aware of the fraud tactics and the daily practices they can embrace in their lives to stay safe from fraud. Banks and other financial institutions are required to run such customer awareness campaigns regularly. Thus, fulfilling the responsibility of customer service becomes easier and more effective for banks.

Nonetheless, the battle against the growing danger of UPI fraud will be won collectively when, along with the initiatives taken by banks, the government takes stern actions against proven UPI crimes and issues strong regulatory measures to control the activities of fraudsters.

BANKiQ: Your Trusted Digital Payment Security Partner

Enabling adaptive intelligence powered with machine learning and deep learning, BANKiQ offers a smart and scalable IFRM (Inline Fraud and Risk Management) solution to protect banks, including both issuer and acquirer, payment service providers or PSPs, payment aggregators, as well as hybrid fintechs from UPI frauds and other types of scams. The solution helps detect and prevent real-time payment fraud, ensuring secure transactions across all payment channels. Besides the FRC system, BANKiQ also provides other solutions like IFRM, PULSE, and IAML to strengthen real-time fraud prevention strategies across banks and other financial institutions.

Final Words

Notable brands like Paytm are already leveraging the advantages of tech-first real-time fraud detection techniques to save their users from UPI payment fraud. It is high time for banks to adapt to the new-age standards and consider embracing real-time payment fraud detection techniques with enhanced digital payment security. In this way, banks can stay ahead of their competitors, ensuring better growth, profitability and customer trust. Moreover, an overall secure digital payment ecosystem is created worldwide, leading to the betterment of the nations.

Tired of the frequent complaints of diverse UPI frauds in your bank? Let us help with our tailored real-time transaction monitoring solutions.