By George Varghese

Executive Director

Fraud and Instapayments: Navigating Risks in Digital Payment Ecosystems

The shift away from cash has resulted in increased use of electronic payments, facilitating instant payment transactions. In the digital age, instant payments are seen as a savior and an alternative mode of payment, which has a growth potential of about 289% by 2027, as predicted by Statisita. The rise of instant payments has garnered momentum among stakeholders and consumers due to their feasibility of transferring money in less than a minute, reducing the waiting period. Reflecting back to the days when money transactions took a day’s time frame with manual visits to banks, the convenience offered today is immediate and powerful. The rise of real time payments has helped businesses of all sizes gain control over real-time transactions, empowering seamless credit and debit transactions. The primary contributors to digital payments are UPI in India, Aani payments in the UAE and FedNow in the USA, leading India and the USA to become the largest consumers of instant payments by 2027. The growing demand for instant payments is mainly due to their speed, which takes a minimum of 10 seconds to reach the beneficiary.

The growing popularity of instant payments on one side is essential and innovative in the modern business world. However, the other side is dark, with digital frauds soaring to new heights on a daily basis. While instant payments offer a wide range of usage to consumers, their weak spot makes them a less reliable method of payment. The year 2022-2023 registered about 47.25% of crimes related to UPI frauds, insisting on the need for a robust framework that safeguards consumer’s personal details and cash against fraudsters. The increasing reliance on technology for instant payments is one of the major contributing factors to digital financial crimes. The need for fraud and risk management in instant payments has risen with the number of fraud cases getting registered every day.

This blog will be a study of how real-time payment systems operate and their differences from the traditional payment landscape that is responsible for the frauds that occur within instant payments. As you delve further you can find a detailed study of the mitigation strategies from BANKiQ that will help your business securely navigate the intricacies of the payment ecosystem.

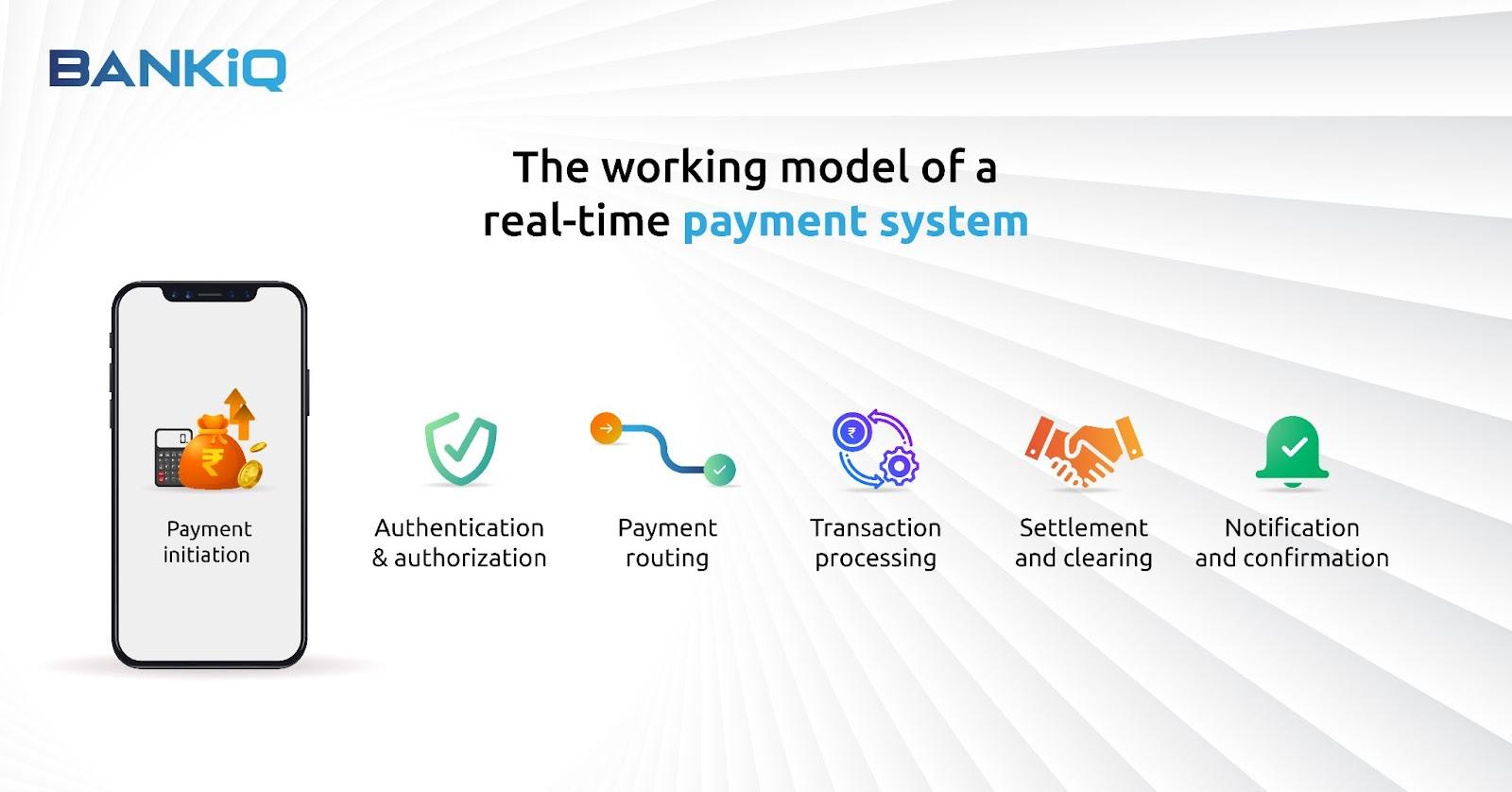

The working model of a real-time payment system

Payment initiation

The payment process begins when a sender decides to start a transaction with a receiver either through a bank mobile application, through the bank web portal or through an API integrated third party app. The payer enters the required information for the payment processing to start. The credentials include the receiver’s name, account details and amount to be transferred, along with other details the platform might require.

Authentication and authorization

After the entry, the payment service provider authenticates the transaction request initiated by the payer through 2-factor authentication, cryptographic techniques or biometric verification. Once this is cleared, the payment service provider checks on the payer’s availability of funds and then processes the payment, clearing the fraud detection mechanisms.

Payment routing

The payment is cleared between the payer and receiver upon routing through a payment network that facilitates the transfer of funds between two financial entities. Depending on the type of payment, for example, UPI, IMPS, or NEFT, the payment will be routed through the respective payment channels. These channels include the national payment gateway, the interbank, or between two different bank portals.

Transaction processing

As it is an instant payment process, the payment is done in real-time facilitating transactions in minutes from the payer account to the payee account. The transaction message is formatted in ISO 20022, NACHA, or proprietary formats, empowering organizations to have a secure real-time transaction.

Settlement and clearing

Based on the payment infrastructure, the payment is cleared either bilaterally between the payer and payee account or through a centralized clearing house. This kind of payment settlement benefits both the beneficiary and the payee.

Notification and confirmation

Once the payment is settled, both parties receive a notification from their respective banks and payment gateways, enabling them to be aware of the transactions. The notification is sent through either SMS, mail or a push notification from both their respective bank’s portals.

Thus, the process of instant payments concludes, delivering a seamless and significant experience for users of the modern age. The reliance on advanced technologies and real-time processing capabilities makes instant payments stand out from the crowd, both in terms of feasibility and the number of fraud scams happening in a day.

A comparison study on traditional Vs. instant payments

It might be fascinating to know why instant payments are prone to easy fraud and scams compared to traditional payment processing. A dive into the reasons might help in building a framework that is flexible and cognitively intelligent to mitigate instant payment frauds.

| Particulars | Instant payments | Traditional payments |

|---|---|---|

| Speed of transactions | The instantaneous nature of the transactions presents a narrow window for fraudsters to get hold of the transfer amount just by gaining unauthorized access. This eliminates the possibility of the banking ecosystem in preventing real time fraud detection. | Whereas in traditional payment methods like cheque or wire transfers, the transfer is done in a day’s time, empowering the banking system to indulge in thorough fraud and risk management. |

| Limited or no reversibility | The way to reverse an instant payment is practically challenging in the case of a scam or fraud. | The traditional payment process is flexible, providing assistance in any mishap by disputing fraudulent charges or reversing the payment process. |

| Authentication and authorization | Instant payments rely on authorizations like passwords, PINs or biometric verification, posing as a weak spot for fraudsters through activities like phishing, social engineering or any other mechanisms. | Based on tight security protocols like sender signatures in cheque or secure login credentials in net banking, traditional payments are less prone to fraud and other risks. |

| Account take over risks | This kind of fraud is highly evident in instant payments, where fraudsters gain unauthorized access to account holders because of not so tight credentials. | The scam is prevalent in traditional payment processing as well, but is low when compared to instant payments. The underlying authentication mechanisms, such as multi-factor authentication or transaction limitations, help keep these risks at bay. |

This table provides a clear idea of why and how instant payments serve as a weak spot compared to the traditional payment processing ecosystem. It also places emphasis on the inability of the banking ecosystem to provide a more refined and defined real time fraud detection system, which is the need of the hour to effectively combat the rising number of fraud cases.

So what kind of fraud exactly happens in instant payment?

Phishing: Tricking individuals through fake SMS, email and other notifications to lurk their security credentials is the most common form of fraud the instant payment ecosystem is bombarded with. It is reported that about 12 fake messages Indians receive on a daily basis target users to disclose their account details or UPI passwords.

This type of scam is very common in India today, where organizations or individuals receive email notifications from banks stating they have an update to be checked and asking the victim to click on the pasted link. Upon clicking the link, the victim is directed to a page similar to the bank’s website to enter their personal details and other sensitive information. The victim, failing to notice the scam and phishing activity, tends to fall for this. Thus, the fraudster gains access to the victim’s bank details, enabling account takeovers in instant payment systems.

Identity theft: Accessing unauthorized accounts by robbing their name, address, social security number, or financial data results in more identity theft and scams.

Consider the situation: where your unsecure Wi-Fi passwords serve as the gateway for fraudsters to intercept sensitive information such as passwords, account details and other information that might help the fraudster know more about your identity. The fraudster will now impersonate the victim to access his/her instant payment account to pursue unauthorized transactions, exploiting the user’s identity without consent.

This process of identity theft in instant payments cannot be helped unless individuals become aware of their environment and a proactive approach is followed where real time fraud detection and transaction monitoring tools are integrated into the banking ecosystem.

Social engineering: A process that involves manipulating individuals through pretexting or impersonation to deceive users into authorizing fraudulent transactions or sharing their account details willingly. This kind of social engineering tactic utilized by fraudsters is one of the modern ways of breaking the payment ecosystem.

While phishing is a form of social engineering scam, fraudsters target victims beyond phishing, such as through pretexting (creating a false scenario to extract information), impersonation (posing as someone else to gain trust), or baiting (luring victims into a trap).

The above fraud types indicate that instant payments are severely prone to risk and financial crimes. A proactive measure is the need of the hour to address the rising fraud scams in the instant payment ecosystem. For a strategic real time fraud detection system, it is essential to have agile and flexible fraud prevention solutions that are of the modern age and have cognitive intelligence in identifying real time transactions.

The significance of incorporating fraud detection mechanisms

An analysis of the necessity of a fraud detection mechanism can help gain knowledge and understanding before choosing a real-time fraud detection solution.

Real-time monitoring: As instant payments happen within 30 seconds, it is important to have a real-time monitoring transaction tool that helps identify unauthorized transactions and scale them out at the same speed of the transaction.

Regulatory compliance: Instant payment systems are volatile and highly voluminous transaction services that require frequent checks on their adherence to the latest laws and regulations. Deploying a real-time fraud detection solution can help organizations navigate the intricacies of regulatory penalties without much hassle.

Enhanced customer experience: Minimizing disruption to legitimate transactions through a robust real-time transaction monitoring tool ensures customers that their credentials and sensitive data are safe and secure. This not only increases the user experience but also gains customer loyalty and trust in utilizing instant payments.

Fraud schemes: Traversing through the tactics and strategies of fraudsters for instant payment is quite challenging, for they are well refined and complex to crack. The integration of a real-time fraud detection mechanism that employs advanced analytics, machine learning, and artificial intelligence helps detect emerging fraud patterns and adapt to evolving threats effectively.

BANKiQ: Providing secure and simplified solutions for instant payments

As instant payments cannot be overlooked in the current digital economy, addressing their concerns can be a challenging yet rewarding experience if guided in the right direction. Availing assistance from BANKiQ can help your business fortify the instant payment transaction window with its comprehensive one-platform solution that offers real-time, cross channel monitoring capabilities highly beneficial for the instant payment ecosystem.

You may be wondering, What is the need for a real time fraud prevention platform when banks can provide the same security? Well, banks are designed to manage your monetary funds with limited security features. It can be complex for traditional infrastructure to address this highly fluctuating landscape that has a very low transactional window frame. Opting for Fraud Risk Management (FRM) solutions from BANKiQ can help you elevate the game of instant or real time payments to a higher level that is more secure and safeguarded from hackers who are well-versed in breaking every weak point of the payment ecosystem.

Being a modern age platform driven by ML algorithms, your business can

- Stay away from fraudsters in any disguise

- Monitor near real-time transactions

- Handle any volume of transactions per day

- Respond swiftly—about 100 milliseconds—to fraudulent transactions

But how?

Cognitive AI-ML enabled: Help detect vast amounts of data in real time for unusual patterns of transactions with high accuracy and speed, preventing unauthorized payments and financial loss.

Rules & scenarios: Packed with pre-defined rules, BANKiQ solutions are customized specifically for instant payments, empowering users to flag real-time transactions for fraud and scams.

Pre-filters: Assist in identifying lists of potentially fraudulent accounts and risky transactions, preventing disruptions that may cause financial and reputational loss to payment service providers and acquirers.

Micro-service based architecture: Built on an advanced infrastructure, BANKiQ solutions help analyze every section of the transactions swiftly before letting the next phase of transactions occur, minimizing errors and responding to new threats as they evolve.

Instant payments have made us inclined towards them for their speed, convenience and feasibility. But that doesn’t mean you have to interact with them, along with financial fraud and crime. Leveraging modern real time fraud detection solutions for modern problems can help reduce the risk of utilizing instant payments.

Be proactive and preventive with BANKiQ!

Conclusion

Before we wrap up the article, it is to be noted that digital inclusion in the payment sector has just started, and before it becomes too complex to handle, let’s unify to address the issues. From acquirers (banks) to payment service providers (payment aggregators), everyone’s requirement has been the same and it is to protect their payment services from financial fraud and crimes. BANKiQ’s concern has also been the same; hence, they have come up with a solution that is well-defined, comprehensive, real-time and modern. For the evolving threats, solutions like swift responses to transactions, real-time monitoring capabilities and the ability to analyze large volumes of data are essential.

Fortifying platforms with just an authentication mechanism will no longer yield results as fraudsters are ahead in technology and tactics. Why not adapt your business to this?

Make the right move today with BANKiQ and join the club of financial institutions that are way ahead of the curve!. Get started on the journey of securing your financial platforms free of instant payment frauds by reaching out to the experts at BANKiQ now!