Payment Frauds In Small, Mid-Sized & Cooperative Banks: Trends, Risks, And Solutions

Introduction

Fraudsters are no longer targeting large banks. Small, midsize, and cooperative banks have become their new targets or even their new favourites.

Do you know why?

One of the reasons is that large banks have invested in high-level security systems with Artificial Intelligence (AI) and Machine Learning mechanisms and strong regulatory compliance, which makes it difficult for fraudsters to steal money.

Small banks do not have the same level of defences in their payment ecosystems, which can become easy targets for illicit actors. The interesting point to highlight is that payment fraud isn’t just a normal stolen credential and phishing scam; it has reached one step ahead. It’s evolving rapidly, driven by AI, real-time payment systems, and open banking vulnerabilities.

A question may arise: How do they impact smaller financial institutions? And most importantly, how can they fight back?

In this blog, let’s discuss the risks, trends, and solutions to payment fraud in small, midsize, and cooperative banks.

Payment Fraud Risks: Common Myths & Facts:

Click. Pay. Gone. In a millisecond, fraudsters can syphon funds from your account by making online payment frauds. Many people believe that the prevention of online transaction fraud is infallible, but scammers constantly devise new methods to circumvent payment security measures.

From fake UPI links to AI-powered scams, misconceptions about transactions make users vulnerable.

Let’s take a look at some of the common myths about payment fraud risks that revolve around small, middle, and cooperative banks.

Myth: 1 Only large banks can be targeted

Fact: The unwritten truth is that you need to understand that large banks can be targeted, yet fraudsters will not choose banks based on their size. Fraud deceivers only target banks with weak security postures, making them susceptible to easy compromise and exploitation.

Many digital payment frauds in India and other countries happen in financial institutions with outdated fraud detection systems, not with the size of the banks.

Myth: 2 Strong KYC is Enough

Fact: While Know Your Customer (KYC) is undeniably effective, fraudsters continue to innovate. Synthetic identity fraud blends real and fake data, fooling traditional checks. The integration of online fraud prevention requires advanced AI-enabled fraud detection systems that analyse behavioural patterns, detect anomalies, and flag suspicious activity before it occurs.

Myth: 3 Manual Fraud detection

Fact: Even with the potential training for employees, human oversight may still sound valuable, but it will be very slow to match today’s fast-moving scams. Online transaction fraud detection relies on AI-driven systems that examine large datasets in real-time.

By the time manual reviews identify a fraud attempt, the funds have already been depleted. Fraud detection in digital payments must be automated, swift, and proactive.

Myth 4: Fraudsters Only Target High-Value Transactions

Fact: Fraudsters often start with small, unnoticed transactions before making bigger moves. In UPI fraud detection, scammers use “micro-testing,” a technique that uses small transactions to check if stolen data is active and usable for larger fraudulent purchases.

The best fraud prevention solutions for UPI payments and other digital payments monitor every transaction, no matter how small, to detect potential threats, prevent fraud from escalating, and flagging suspicious patterns in real time.

Myth 5: Multi-Factor Authentication (MFA) Stops Payment Fraud

Fact: While MFA adds security, fraudsters use tricks like SIM swapping, phishing, and social engineering to bypass it. Online payment frauds are evolving, so small and cooperative banks need more than just login security.

Multi-layered online payment fraud detection, combined with early warning signals, can spot fraud attempts before customers lose their money.

Note:

Fraud is getting smarter, faster, and more deceptive than ever. Banks and other financial institutions must invest in advanced AI-driven online payment fraud detection and early warning systems to stay ahead of those smarter frauds.

Fortifying Transactions:

Lessons from Payment Fraud Cases

Learning from similar fraud cases helps strengthen security measures and prevent future fraud attempts. Let’s break it down:

Case study: 1

A leading U.S. bank has highlighted the growing risk of financial fraud, particularly for small and mid-sized banks. It includes the threat of both internal and external fraud, such as payment fraud, cyber scams, and unauthorised transactions, which is on the rise.

Payment fraud threats in banking:

- Check and Automated Clearing House (ACH) Fraud: This type of fraud includes counterfeit cheques and manipulated ACH payments leading to forbidden fund transfers.

- Phishing and Payment Scams: Fraudsters deceiving businesses into altering payment details, resulting in fund misdirection.

Key takeaway:

Banks must enhance authentication layers, restrict bulk transactions, and monitor behavioural patterns to detect fraud early. Automated fraud detection can help identify suspicious activities and prevent unauthorised fund transfers.

Case Study: 2

In 2024, Most of the US banks adopted a leading peer-to-peer platform with advanced features and made the transaction process more advanced. However, the roll of the service results in security gaps that were left unchecked on the platform.

Fraudsters leverage this security weakness, stealing over $800 million from customers. The Consumer Financial Protection Bureau (CFPB) later sued these banks and service providers for early warning signals, stating that they failed to implement adequate fraud protection. This incident exposed a critical weakness in fraud detection in digital payments.

Key takeaways for Small, midsize, and Cooperative Banks

- Security Over Speed: It is possible for any bank to offer a swift payment service unless it is a lost cause with a security framework. The reason is that launching digital payment services without strong fraud detection exposes small and cooperative banks to major losses.

- Defined Fraud Liability: Due to the unclear fraud liability, small and mid size banks often struggle with online payment frauds. When these fraudulent customers and banks get caught in disputes, delaying resolution and increasing losses.

Establishing accurate fraud liability policies ensures accountability, reduces conflicts and strengthens fraud detection in digital payments. With Advanced measures and defined rules foster banks and improve trust and security in online transaction fraud prevention.

Unlock the power of BankIQ’s Fraud Detection Solutions to enhance security, reduce risks, and safeguard your banking transactions.

Get started Now

Solutions to prevent payment frauds in Small, Midsize and Cooperative banks: Before & After Scenarios

Weak Fraud Detection = Major Losses

Before: Many small banks relied on manual fraud detection, leading to delayed responses. Fraudsters exploited gaps using synthetic identities and low-value test transactions before executing large-scale fraud.

Impact: Banks can suffer huge financial losses, and fraud often went undetected until customers reported unauthorised transactions.

After: Advanced AI-Powered Real-Time Fraud Detection

AI-driven systems now analyse transactions instantly, identifying anomalies before fraud occurs. Automated alerts stop unauthorised payments in seconds, reducing financial exposure. Additionally, banking systems implement early warning systems to swiftly detect payment fraud and secure operations of small, midsize, and cooperative banks.

Small Transactions Ignored, Leading to Big Frauds

Before: Fraudsters tested stolen payment details with microtransactions before making high-value withdrawals. Most banks didn’t monitor small-value transactions, assuming they weren’t a threat.

Impact: Unpermitted withdrawals may go unnoticed by small banks if multiple small test transactions are ignored, potentially leading to larger fraudulent transactions.

After: Monitoring Every Transaction

AI fraud systems track all transactions, flagging suspicious micro-payments.

Fraud detection can alert banks before major fraud occurs and larger financial loss.

Insider Threats & Unrestricted Data Access

Before: Employees with broad access to financial systems increased the risk of internal fraud. Forbidden fund transfers went undetected due to a lack of access controls and oversight.

Impact: Financial losses and reputational damage, leading to a decline in customer trust.

After: Access to financial systems is now restricted through Role-Based Access Control (RBAC), ensuring only permitted personnel handle sensitive payments. Comprehensive audit logs track every transaction, making it easier to detect suspicious activities and prevent illicit actions.

Weak Controls Against Money Muling

Before: Fraudsters exploited gaps in KYC verification to open mule accounts using fake or stolen identities. Large-volume transactions were processed through new accounts without restrictions, making it easier for criminals to launder money.

Impact: Banks faced increased exposure to financial crime, risking penalties and reputational damage.

After: Strengthened KYC & Transaction Controls Enhanced Know Your Customer (KYC) verification ensures strict identity checks during account onboarding, blocking fake credentials. Transaction limits restrict high-volume transfers for new accounts until credibility is established.

Emerging Fraud Trends in Small, Mid-Sized, and Cooperative Banks

Fraud tactics are evolving, posing new challenges for small, mid-sized, and cooperative banks. Fraudsters are finding ways to exploit vulnerabilities in lending, payments, and transaction security.

Here are some key fraud trends affecting these banks today:

Increase in SMB Lending Fraud: Fraudsters are using stolen business and personal identities to secure loans, making it harder for banks to detect fake applications. Digital lending platforms are particularly at risk.

Rise in Authorised Push Payment (APP) Scams: Scammers manipulate victims into sending money to fraudulent accounts through real-time payment systems, making these transactions difficult to reverse.

Urgency for Real-Time Fraud Prevention: Small and mid-sized banks need stronger fraud detection measures that can identify and block suspicious transactions in real time before funds leave the institution.

BANKiQ PULSE: Smarter Fraud Detection for Growing Financial Institutions

BANKiQ PULSE is a hosted Fraud Risk Management (FRM) solution that helps small, mid-size and cooperative banks, preventing digital payment fraud. It leverages AI-driven risk detection and automated compliance to safeguard transactions and detect fraud in real time.

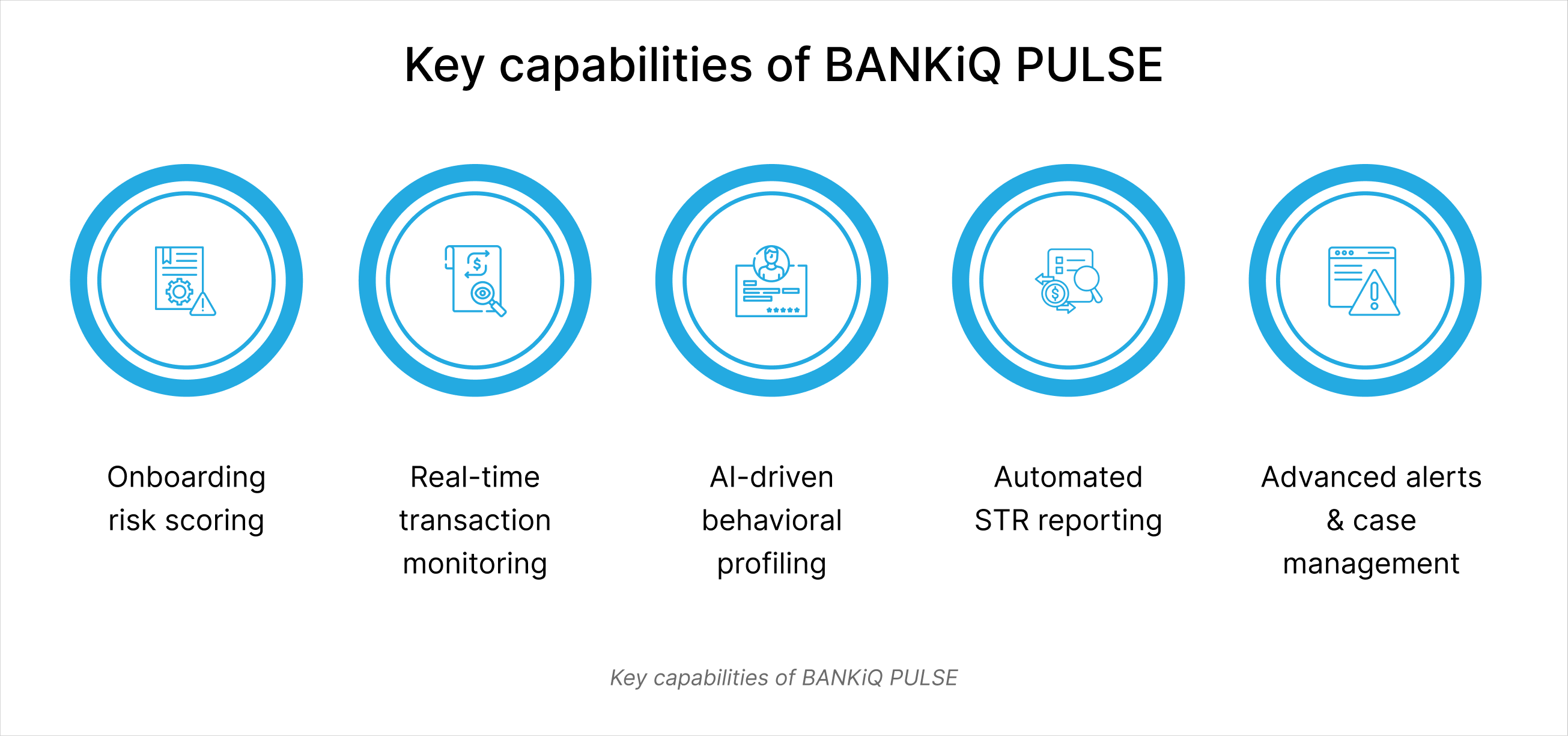

Key capabilities of BANKiQ PULSE are:

- Onboarding risk scoring

- Real-time transaction monitoring

- AI-driven behavioral profiling

- Automated STR reporting

- Advanced alerts & case management

With BANKiQ’s advanced fraud prevention solution, banks (regardless of size) can proactively detect suspicious activities, mitigate fraud risks, and ensure regulatory compliance while enhancing transaction security.

Final Note

Payment fraud is no longer a threat; it is a reality that small, midsize and cooperative banks must tackle proactively. With evolving fraud tactics, manual detection no longer serves. Relying on traditional methods is no longer sufficient, as fraudsters continuously evolve their tactics, exploiting security gaps and outdated detection systems.

Intelligent, automated, and adaptive fraud prevention solutions detect and adapt to the rise of new threats. By embracing innovation in fraud risk management, banks can protect their reputation and build long-term trust with the clients.

Fraud never rests; neither should your bank’s security. Connect with the professionals at BANKiQ to protect your banking operations and maintain a competitive edge in the industry.