A Deep Dive into Real-time Fraud Detection and Its Role in Combating UPI Frauds

Introduction

While UPI makes transactions effortless, it also leaves banks and their users vulnerable to fast-moving fraud. Contributing to this fact, a UPI scam involving 14.8 lakhs was reported, with inefficient authorisation methods as its root cause. This widespread lapse in authorisation highlights how evolving UPI scams have raised alarm among banks and users alike, urging a reassessment of real-time authentication mechanisms.

In this context, two key fraud detection approaches come into play: Pre-Authorisation (Pre-Auth) and Post-Authorisation (Post-Auth). These approaches define when and how a transaction is analysed for fraud, either before it’s processed or after the funds have been debited.

This blog explores the two primary approaches to UPI transaction authentication, such as Pre-Authorisation (Pre-Auth) and Post-Authorisation (Post-Auth), and compares them to determine which offers stronger protection against real-time fraud.

Two Main Approaches to Authorisation

In the world of UPI payments, the transactions focus on speed and real-time money transferring, which opens several pathways for UPI fraud. In order to mitigate these fraudulent activities, banks and other financial institutions adopt various forms of authentication to legitimise transactions. Banks use two main authentication approaches to secure their transactions: Pre-Auth and Post-Auth.

Pre-Auth (Pre-Authorisation)

Concisely, Pre-Auth acts as a real-time payment authorisation step for fraud detection. This verification of the receiver’s authenticity occurs before the funds are withdrawn from the user. The front-loaded authentication ensures that the user maintains full control over the transaction, minimising the risk of unauthorised or fraudulent transfers.

Post-Auth (Post-Authorisation)

To the point, Post-Auth acts as a verification step that identifies fraud after the funds are debited. This step of authorisation alerts the user and the bank if the transaction is flagged as fraudulent after the money is debited, which is irreversible.

For a deeper and clearer understanding, drawing comparisons between these two approaches will be ideal.

Pre-Auth vs Post-Auth

| Factors | Pre-Auth | Post-Auth | |

|---|---|---|---|

| 1 | Function | Pre-Auth stops potential fraudulent transactions before money is debited by analysing user behaviour, metadata, and contextual signals in real-time. | Post-Auth flags suspicious activity after the transaction has been processed, helping detect fraud patterns that slipped past initial filters. |

| 2 | Time of authentication | Pre-Auth's Authentication and fraud checks happen before the user enters the UPI PIN, enabling real-time blocking of malicious transactions. | Post-Auth's authentication happens after the transaction is completed. Detection is reactive, typically through reconciliation or anomaly reports. |

| 3 | Speed | Pre-Auth is extremely fast compared to Post-Auth. It is suited for immediate decision-making, especially in phishing, impersonation apps, or payment manipulation attacks. | Post-Auth is slower compared to Pre-Auth. It works after the transaction by analysing payment histories and behaviour to identify patterns of repeat fraud or systemic issues. |

| 4 | Risk Mitigation | Pre-Auth helps prevent monetary loss upfront by halting transactions at the point of suspicion. Best suited for first-line defence. | Post-Auth supports post-event investigations and helps to refine future rules. Useful for building intelligence, not real-time protection. |

| 5 | Data Inputs | Pre-Auth relies on real-time device metadata, app behaviour, geolocation, transaction velocities, channel-specific risk indicators & dynamic rule engines. | Post-Auth uses historical logs, batch data, reconciliation files, case audit trails, and post-facto anomaly reports to analyse fraud trends. |

Though both of these steps of authorisation methods are mandatory, Pre-Authorisation has been proven to be more efficient and recoverable in the face of transactions for its real-time fraud detection protection.

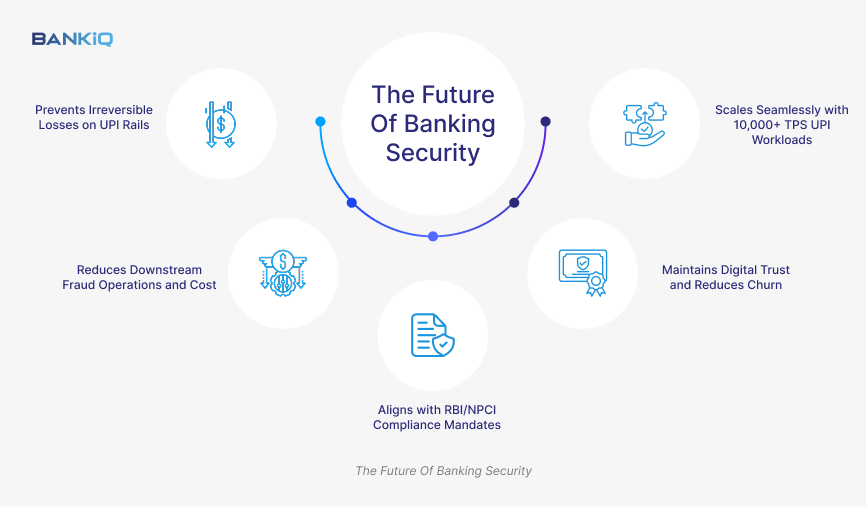

Real-Time Fraud Detection: The Future Of Banking Security

1. Prevents Irreversible Losses on UPI Rails

UPI transactions settle in real time and are non-reversible, with no chargeback mechanism available once a payment is authorised. Pre-Auth fraud detection addresses this risk by introducing multi-layered, real-time risk checks before PIN entry. Using behavioural signals, device intelligence, and network context, it processes and evaluates transaction risk in under 150 milliseconds. This ensures that high-risk or fraudulent transactions are intercepted before funds leave the customer’s account, effectively eliminating fraud loss at the source.

2. Reduces Downstream Fraud Operations and Cost

In post-auth and legacy authentication methods, banks and financial institutions are forced to face the aftereffects of the UPI scams, such as manual fraud reviewing, answering customer queries about the scam, reimbursement of liabilities, and facing legal disputes. These processes and services are laborious, time-consuming, and highly expensive for businesses to incur.

By opting for real-time fraud detection, like Pre-Auth, banks are relieved from such workloads, financial obligations, and reputational damages. Pre-auth detection filters out all the obvious fraudulent transactions before the transaction is initiated. Its proactive response to the situation mitigates banks from all the above-mentioned overhead costs and operations.

3. Aligns with RBI/NPCI Compliance Mandates

The Reserve Bank of India (RBI) and the National Payments Corporation of India (NPCI) have tightened the security infrastructure of digital payments like the UPI and IMPS by introducing pre-transaction behavioural monitoring. It is mandatory for all banks to obtain real-time fraud detection authentications to not only mitigate UPI scams but also to evade any legal and regulatory issues.

The authentication generally includes

1. Inline transaction scoring

2. Behavioural biometrics and contextual risk analysis

3. Adaptive authentication flows (e.g., challenge via OTP)

Banks using Pre-Auth engines are better equipped to demonstrate proactive fraud frameworks, which is now a compliance differentiator during inspections and audits.

4. Maintains Digital Trust and Reduces Churn

In the Indian landscape, where people are gradually increasing their reliance on UPI transactions as their main source of transactions, an increase in UPI payment frauds will contribute to the deterioration of goodwill and distrust in digital transactions. Adopting real-time fraud detection authorisation, which acts as a shield and immediately responds to any sort of anomalous activity, will build assurance among customers.

Pre-auth alerts the user and the banks and, at times, rejects payments at the site of compromised transactions. This system of proactive detection and alert brings trust in the banks and the payment platforms, as customers never experience the fraud firsthand. Especially in the era of instant apps, P2P platforms, and QR payments, stopping the fraud before it hits the customer is the strongest loyalty strategy banks can deploy.

5. Scales Seamlessly with 10,000+ TPS UPI Workloads

Banks operating on UPI today face volumes that peak at 10,000 to 50,000 Transactions Per Second (TPS) during prime hours. A Pre-Auth system is built with

- Real-time decision APIs optimised for sub-200 ms latency

- Event-driven microservices that score each transaction independently

- Horizontal scalability via Kafka, Redis, and edge inference models

This architecture ensures:

- Real-time risk analysis at massive scale

- Zero impact on transaction speed or app UX

- Seamless handling of fraud risk without bottlenecks

Secure Your Transactions with BANKiQ

BANKiQ has solely focused on the transformation of digital payment security to the extent of incorporating top technological advancements like ML, AI, and real-time analytics. Through their Inline Fraud and Risk Management (IFRM) products, they offer top-tier digital security to banks, financial institutions, and payment solutions providers. With main offices in the UAE and India, their services spread worldwide, focusing on real-time fraud detection and mitigation to empower banks against financial crimes.

Final Words

By choosing real-time fraud detection, such as Pre-Auth, banks can mitigate UPI fraud with less effort and more precision and efficiency. Its proactive approach, rapid identification, suspicion alert, and payment-rejecting strategies have proven more efficient than post-Auth or any other authentication methods. By utilising real-time fraud detection approaches, banks and financial institutions can achieve milestones in customer trust, anti-fraud, and adherence to compliance.

Is your bank ready to face financial fraud? Let’s start a conversation.